|

State Board of Equalization News Release Chairman Jerome E. Horton Third District – Los Angeles County |

Cynthia Bridges Executive Director |

||

|

For Immediate Release February 13, 2015 |

NR 11-15-H Contact: Office of Public Affairs 1-916-327-8988 |

||

BOE to Consider 7.5 Cent Gasoline Excise Tax Rate Cut

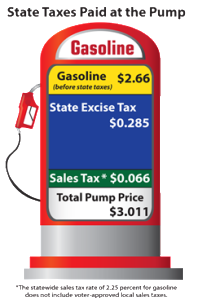

Sacramento – The California State Board of Equalization (BOE) will consider lowering the excise tax rate for gasoline by $0.075 for Fiscal Year (FY) 2015-16 during its February 24, 2015 meeting in Culver City.

Gasoline Tax Structure Change in 2010

Drivers pay two types of state taxes on gasoline — sales tax and a per gallon excise tax. The “fuel tax swap” lowers the sales tax rate to 2.25 percent on gasoline and requires the BOE to set the per gallon excise tax rate, so drivers pay the same amount of state taxes on gasoline as they would have paid under  the prior tax structure.

the prior tax structure.

Before the “fuel tax swap” took effect in 2010, drivers paid the full sales tax rate (then 8.25 percent), and an excise tax of $0.18 per gallon. Since 2010, the “fuel tax swap” law has required the Board to adjust this tax rate by March 1st of each year.

If adopted, between July 1, 2015 and June 30, 2016, the excise tax rate on gasoline will be $0.285 per gallon. The current excise tax rate of $0.36 is in effect until June 30, 2015.

The excise tax on gasoline pays for public road improvements and mass transit. In FY 13-14, the BOE collected nearly $5.8 billion for the Motor Vehicle Fuel Account, Transportation Tax Fund. Sales tax funds a variety of state and local programs.

BOE’s Mandated Role

The BOE is required by law to adjust the excise tax rate each year. The fuel tax swap has a “net-zero” effect on the price of gasoline, which is driven by market conditions.

How the Rate is Calculated

The projected average gas price during FY 15-16 is $2.66 a gallon, which includes the federal excise tax of $0.184 but not state gasoline taxes. The number of gallons sold is expected to remain steady during FY 15-16.

In addition to projecting sales tax revenue that would have been generated under the old tax structure, the law also requires the BOE to review the actual excise tax revenue generated in the prior fiscal year and subtract that from projected revenue for the coming fiscal year. This calculation determines the coming fiscal year’s rate.

Watch this video explanation to see how it works, and visit our media resources page for more information.